Research

DeFi: France must not miss the future of finance

On March 18th, Adan organised a conference on the theme of decentralised finance. This event took place in the context of the ongoing work on the proposed European MiCA (Markets in Crypto-Assets) regulation, which is worrying the crypto-blockchain sector and raising doubts about the future competitiveness of the European industry.

The contributors were: Stanislas Barthélémi (Blockchain Partner by KPMG), Sébastien Couture (Director of Communications at Adan and host of the Epicenter), Faustine Fleuret (Director of Strategy and Institutional Relations at Adan), Fabrice Heuvrard (Chartered Accountant, Auditor and Co-founder of Token Strategy Advisor), Xavier Lavayssière (Lecturer at Paris 1 Panthéon-Sorbonne and Founder of ECAN) and Simon Polrot (President of Adan).

“DeFI is an alternative to the banking system based on open blockchain networks”

Stanislas Barthélémi explains that DeFi – or Decentralised Finance – is a new financial system based on open blockchain networks.

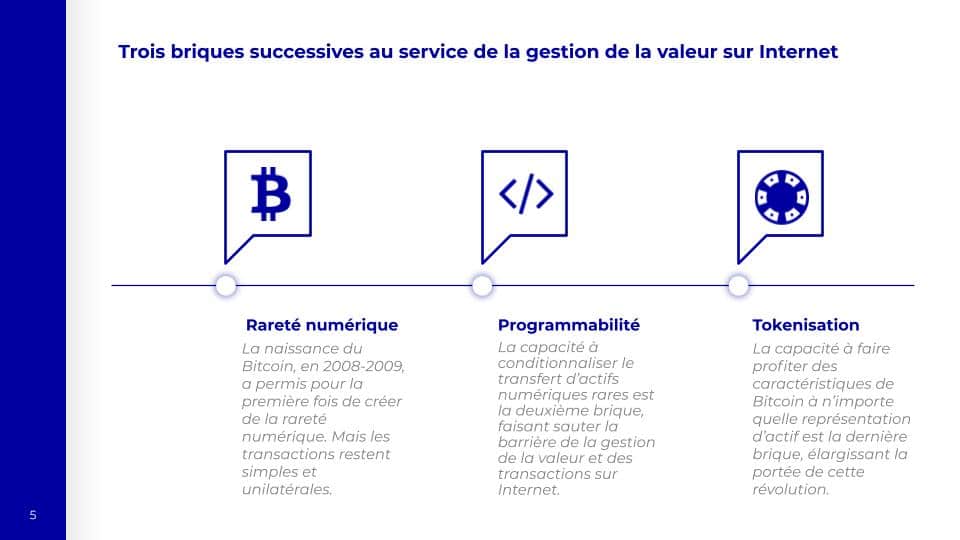

He reminds us that the internet of value in which DeFi is anchored is an innovation based on three fundamental bricks: the digital scarcity with crypto-assets, the programmability of these natively digital assets through the use of smart contracts, and the tokenisation of assets, i.e. the representation by crypto-assets of other tangible or intangible assets.

This DeFi allows open access to any type of actor wishing to interact with the various financial applications.

All operations are made accessible to users whether they are individuals or institutions: from simple operations such as opening an account, investment, placement, to complex operations such as creating a financial product or raising funds. The operations can be automated and therefore accelerate the speed with which capital circulates in this ecosystem.

In addition, each financial application becomes interoperable with the others, we can speak of financial “legos” that can be combined to create more complex use cases.

He also notes the emergence of financial services on open and public blockchains, notably Ethereum. In recent years, a range of services and products have emerged such as stablecoins, crypto-assets whose prices are automatically indexed to another asset, decentralised exchanges, marketplaces without a central operator, and decentralised markets for lending and borrowing functions.

The total amount locked up in DeFi apps has grown exponentially over the past year. From $1 billion in the summer of 2020, it is now $50 billion.

DeFi in France: a lot of interest but a loss of talents.

The interest in crypto-blockchain technologies in France is well established, and this was the case long before the emergence of DeFi. Indeed, in the early 2010s, several communities were already present and a few companies were being created. But the phenomenon of DeFi creates a new movement that is taking on a significant scale.

Indeed, a large community of enthusiasts is present in France, in particular the DeFi France community which has several thousand followers and regularly organises events.

This is confirmed by the number of international DeFi projects led by French people – there are more than ten companies in the sector with French founders. We also note that many French people are present in the teams of the most important DeFi projects in the ecosystem. However, it is regrettable that few projects exist on French territory, a symptom of the regulatory framework that is not very favourable to the development of a competitive ecosystem.

“Many DeFi players are trying to make DAOs to avoid being in a territory and a regulation”.

Xavier Lavayssière draws a contrasting picture of an Europe that shows political will but is lagging behind in the development of its digital asset and DeFi sector. Although blockchain operations are decentralised, there are nevertheless both strategic and political issues between nations.

The progress of the United States can be seen in several ways. The first indicator is that almost all stablecoin transactions are denominated in US dollars, which reinforces its status as the reference currency. There is also a well-developed ecosystem, with well-funded new players and established fintech companies now offering the capacity to buy and sell cryptocurrency to their users. Finally, the US federal and local authorities have been quick to take up the subject. Despite the complexity of the US system and the divergences between players, a certain maturity and a clear message encouraging and facilitating the use of crypto-assets by players in the banking and financial sector is now being reached.

On the side of the users of digital assets and by extension of the DeFi projects, we note the preponderance of the USA and Asia. There are secondary hubs such as the UK, which has a lead over France on the crypto topic. The explanatory factors combine economic and cultural aspects and the consumer protection bias.

We also note a large number of ambitious projects led by Europeans, including French people, but whose structures are located abroad. However, a French-speaking community has been present for years, first with Bitcoin then Ethereum and now DeFi.

The development of DAOs (decentralised autonomous organisations) in DeFi offers, in theory, the prospect of new forms of economic cooperation, partly free of territorial anchorage and therefore of applicable regulations. In practice, many legal issues such as the liability of founders need to be addressed. Three approaches seem to be under consideration: agreements with the authorities as in Switzerland, legal recognition as in the State of Wyoming where a bill aims to recognise DAOs and the contractualist approach, relying on flexible company law as in the State of Delaware to preserve the characteristics of a DAO within a legal framework.

“The GAFAs of tomorrow will be financial services”

While the States and Europe have a defensive approach to DeFi, the players in the ecosystem have understood that this sector represents the future of financial services for individuals and institutions. This is the position expressed by Sébastien Couture.

France and Europe must seize the subject of DeFi to avoid the mistakes of the past. To understand what is at stake, one only has to look at Europe’s position towards the GAFAs. A defensive position that can be interpreted by the absence of European champions as they exist elsewhere, notably in the United States.

The GAFAs of tomorrow will be retail and institutional financial services, dominated by on-chain players and platforms or those based on open blockchains. As seen with the GAFAs, they will aggregate millions of users in addition to hundreds of millions of transactions per day and hundreds of trillions of dollars in volume each year.

For this reason, France, supported by Europe, must promote the emergence of European champions. There are many ways for States to develop: removing administrative barriers and simplifying procedures, investing in research, adopting open blockchain technologies within States and promoting investment by supporting national and European regulations that allow the sector to develop and stand out on an international scale.

France and European countries have strong and powerful public infrastructures that can and should be put at the service of the development of a competitive industry.

“I expect the State to give us all the tools we need to create DeFi champions in France”.

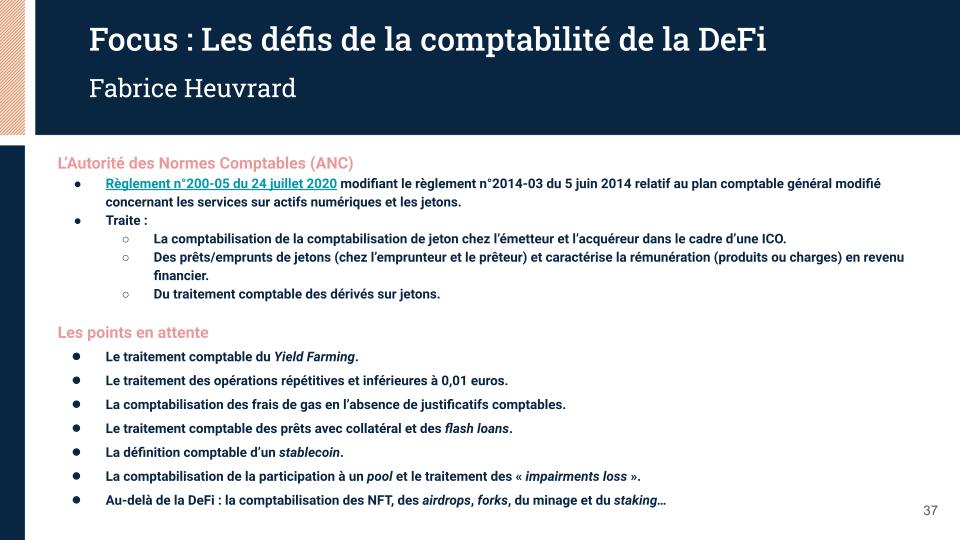

Fabrice Heuvrard regrets that there are very few accounting texts on crypto-assets. In this field, where competition is global, there is a void that makes it difficult for companies to operate their accounts.

From a tax and accounting point of view, many subjects are not covered by the texts, for example: yield farming, the treatment of transactions below 0.01 cents, transaction fees (gas), the notion of impairment loss with regard to liquidity pools, airdrops, mining and staking, the treatment of non-fungible tokens (NFT) and many other topics.

Companies in the sector expect the administration to give entrepreneurs the weapons to compete internationally.

In conclusion, we can ask ourselves a question: how can we encourage the development of DeFi in France?

Simon Polrot answers this question in two stages. In the short term, he recommends fighting the industry’s backwardness by removing existing obstacles. It is crucial to catch up on the fundamental bricks (CeFi, access ramps, etc.) just as it is important for Europe to have strong and competitive players on their territories. Therefore, administrations must support European players and appropriate funding policies must be put in place. Finally, it is essential to develop an understanding of how digital assets work and the opportunities they offer.

In the long term, it is absolutely essential to mobilise public authorities and the financial industry and to address DeFi at the European regulatory level. The fragmentation of ecosystems in Europe is proving too damaging to the development of the common market.