Research

Taxonomy of blockchain-based crypto-assets

A functionnal classification of tokens operating on open and pulic blockchain networks

Since the inception of Bitcoin, the blockchain ecosystem has evolved into an ecosystem of various assets, serving a wide range of applications. With so many tokens serving various applications, both financial and non-financial, it is necessary to establish a functional classification. By understanding functional utility, we hope to help guide ongoing discussions regarding the legal treatment for different asset types.

The purpose of this paper is to present a taxonomy of crypto-assets existing on open blockchain networks with the goal of informing sound policies that take into account their functional applications.

A primer on tokens and crypto-assets

A token is a cryptographic representation of an asset or access rights, registered on an underlying blockchain. Tokens are no more than functional units which may be transferred between accounts – a token has no value in and of itself. The ability to interact with a token is reserved to the party or parties who control its corresponding private key.

Tokens typically represent assets, which may take on different forms and have various applications.

Crypto-assets exist on a more conceptual abstraction level and are imbued with properties that their users and proponents find valuable. These properties may vary, but generally, it is thought that crypto-assets have value because:

- control of said asset is strictly limited to the holder(s) of its corresponding private key(s);

- they are natively digital and useful in an increasingly digital world economy;

- transfers and settlements require no intermediary;

- transfers and settlements are near-instant; and

- they are programmable.

More broadly, crypto-assets represent what many believe to be the future of finance and monetary economics. Much like other technological revolutions of the past century, proponents of crypto-assets have the conviction that crypto-assets will transform the world’s financial system and infrastructure in a truly radical way.

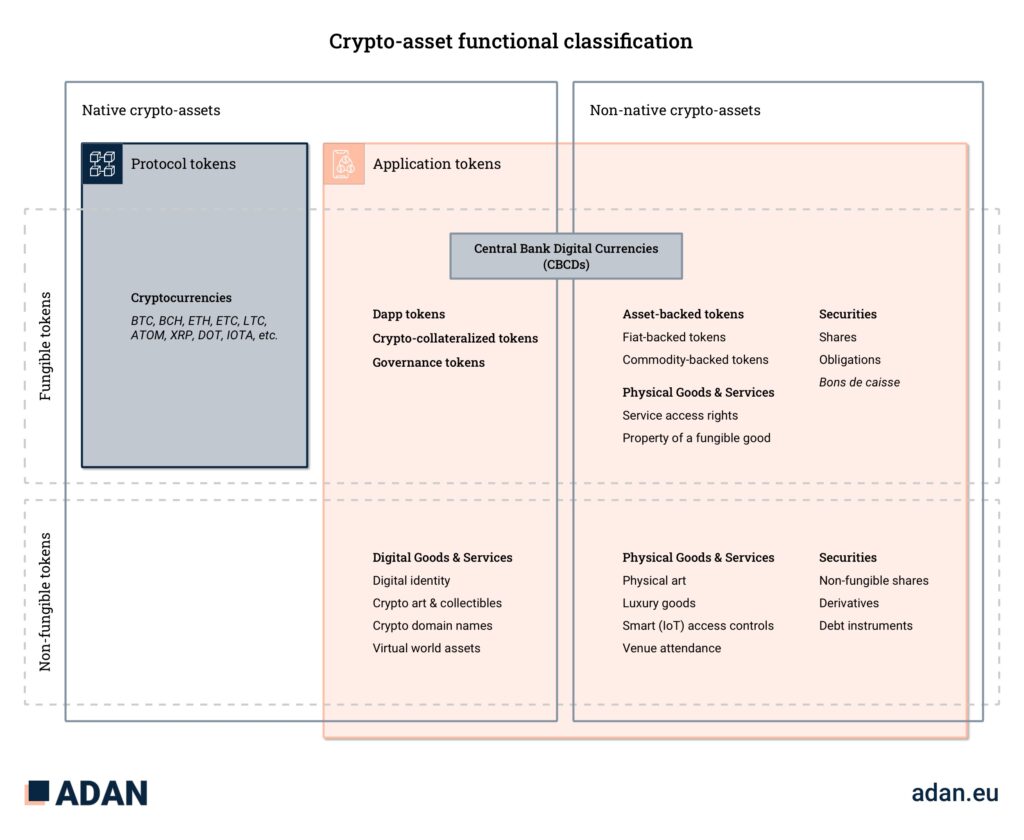

Crypto-asset functional classification

We propose a functional classification for crypto-assets that separates native crypto-assets from non-native crypto-assets. It distinguishes between protocol tokens, which enable crypto-economic incentives on a blockchain network, and applications deriving from smart contracts and other issuance mechanisms. At the same time, our classification considers the functional separation between fungible and non-fungible tokens (NFTs).

Token “nativity” axis

Native crypto-assets

Native crypto-assets are assets whose use and value is derived entirely from their representation on a blockchain. They may represent a cryptocurrency, tokens which serve for the use of blockchain-based applications, voting rights in decentralized governance schemes, access controls for a smart contract, or any conceptual representation of value that is ensured solely by the existence and functioning of a blockchain. A native crypto-asset lacks attachment to objects or existing assets, whether physical or digital, which are not themselves native crypto-assets. Therefore, native crypto-assets have no representation, relationship or value outside of the blockchain on which they exist. This does not imply that their value is solely derived from the blockchain itself. External market forces, driving the demand on those assets, are key to determining their intrinsic value. As an example, the value of a utility token will usually be tightly correlated with the demand for the underlying product, that can be implemented outside of the blockchain (i.e.: a token related to a centralized exchange).

Native crypto-assets fully embody the properties listed in the previous section, and most importantly, property (a), which is about control and ownership of the asset. Native crypto assets may be transferred only by the party controlling the corresponding private key, or keys, in the case of multi-signature schemes or multi-party computations.

Control of a native crypto-asset is materialized by its on-chain representation, and nothing else. In this regard, native crypto-assets function very similarly to actual physical goods, where possession creates a presumption of ownership. Ownership exists only in absolute terms and custody is key, no pun intended.

Non-native crypto-assets (or tokenized assets)

Non-native crypto-assets are assets whose use and value derives from a combination of their blockchain representation and a representation of value that lives outside the blockchain network. Examples of non-native crypto-assets may include asset-backed tokens representing fiat currencies or commodities, financial instruments existing on traditional finance infrastructure, derivatives, rights to intellectual property such as artwork, both physical and digital, or rights to physical property such as real estate. It is necessary for a non-native crypto-asset to be functionally and legally tied to the asset or right existing outside of the blockchain. Control of the underlying asset is necessarily held by a natural or legal person, a group or an autonomous organisation, and is detached from the ownership of the token.

Non-native crypto-assets are a representation of an underlying asset or right. While non-native crypto assets benefit from many of the core properties already discussed, control is more nuanced – control of the asset may belong to the person in control of the underlying asset and the question of the legal qualification of such token is key.

Furthermore, they are digital only by proxy as the underlying asset may still require to change hands along with the crypto-asset. While the on-blockchain representation of the asset belongs to the holder of its corresponding private key, the physical or digital manifestation of the underlying asset means control may be seized.

Non-native assets have functional value, in that they inherit useful properties like instant transaction finality, programmability and so on. They allow physical objects, like art and real estate, and traditional financial assets, like stocks and shares, and access rights, like car keys, and event tickets, to be represented on a blockchain network.

Protocol dimension

Protocol tokens

In relation to a blockchain, the “protocol” refers to the set of rules that maintain consensus across the network. Blockchain protocols leverage game theory, economics and cryptography to construct a system in which participants are incentivized to work towards a common goal: secure the transaction ledger. The rules in such a construction are known as cryptoeconomics. Thus, in cryptoeconomic systems, the protocol token is used as an incentive mechanism to drive behaviour.

The characteristics of protocol tokens are also entirely determined by the protocol itself and cannot be altered unilaterally by any participant. Any change in the behaviour and characteristics of such tokens can only be implemented with the consensus of the protocol operators and users.

Therefore, the protocol tokens are first-class citizens on any blockchain platform.

Application tokens

Modern blockchain networks allow interested parties to deploy applications. Some blockchain platforms include, as core functionality, a set of basic applications which may be easily deployed (e.g., crowdfunding). However, the vast majority of platforms include a mature application development platform and programming language allowing developers to innovate and build any number of financial applications, and thus, issue tokens.

Application tokens are second class citizens on a blockchain platform, as they could not exist without the underlying consensus and platform tokens. In fact, in many cases, the protocol tokens are required to pay transaction fees related to the transfer of application tokens, although novel techniques are bringing change on this front.

Fungibility dimension

Fungible tokens

Fungible tokens represent assets that are equivalent and interchangeable. They may be divided into fractional units and combined into whole units. They overlap native and non-native assets and in most bases represent assets that are financial in nature.

Non-fungible tokens

Non-fungible tokens represent assets that are not equivalent, and not interchangeable. They may not be divided, nor combined. They are typically numbered and represent rights to a physical or digital good which is not inherently financial.

Conclusion

Crypto-assets come in many shapes and sizes, and the crypto-blockchain industry is constantly innovating and finding new applications. Regulating crypto-assets effectively implies understanding the functional applications of various crypto-asset types, and creating rules around the use cases and applications.