Research

The benefits and risks of anonymity enhanced crypto-assets

Introduction

1 – The protection of anonymity through cryptography, a desire that predates the creation of the first crypto-assets.

When the Bitcoin network emerged in January 2009, the notion of anonymity was one of the values held by individuals who supported the development of these digital exchange methods. The most prominent example is the creator(s) of the Bitcoin network, Satoshi Nakamoto, who has remained anonymous to this day.

This defence of privacy on computer networks through encryption and cryptographic techniques is not unique to the Bitcoin network and other crypto-assets. This idea was already carried in the late 1980s by the Cypherpunks intellectual movement. The main contributors to this intellectual movement are Eric Hughes author of Manifesto of a Cypherpunk (1993), Timothy C. May author of Manifesto of a Crypto Anarchist (1988) and The Cyphernomicon (1994) and John Gilmore.

Aware of the risks of new forms of surveillance and censorship in the Internet era, Cypherpunks developed a philosophy centred on the importance of preserving one’s anonymity and emancipating oneself from any trusted third party, be it public or private.

2 – Bitcoin (and most other crypto-assets) transactions are not anonymous, but pseudonymous.

In many ways, bitcoin transactions are not anonymous. This is because each bitcoin holder uses their public address via their crypto-asset wallet to make a transaction. While the identity of bitcoin holders is not explicitly revealed (neither their personal data nor their IP address is included in the transaction), this address – considered a pseudonym – allows anyone to view all transactions made through the network.

While this transparency is beneficial in a number of situations – for example, it offers law enforcement authorities the possibility of linking a money laundering and/or terrorist financing offence with the identity of its offender – it does not offer a sufficient level of confidentiality to guarantee the privacy rights of crypto asset users.

However, privacy is a natural human right, inherent to the frencg constitutionality block and consecrated in article 8 of the European Convention on Human Rights

| “Everyone has the right to respect for his private and family life, his home and his correspondence”. Article 8 ECHR. |

The gradual emergence of anonymous crypto-assets

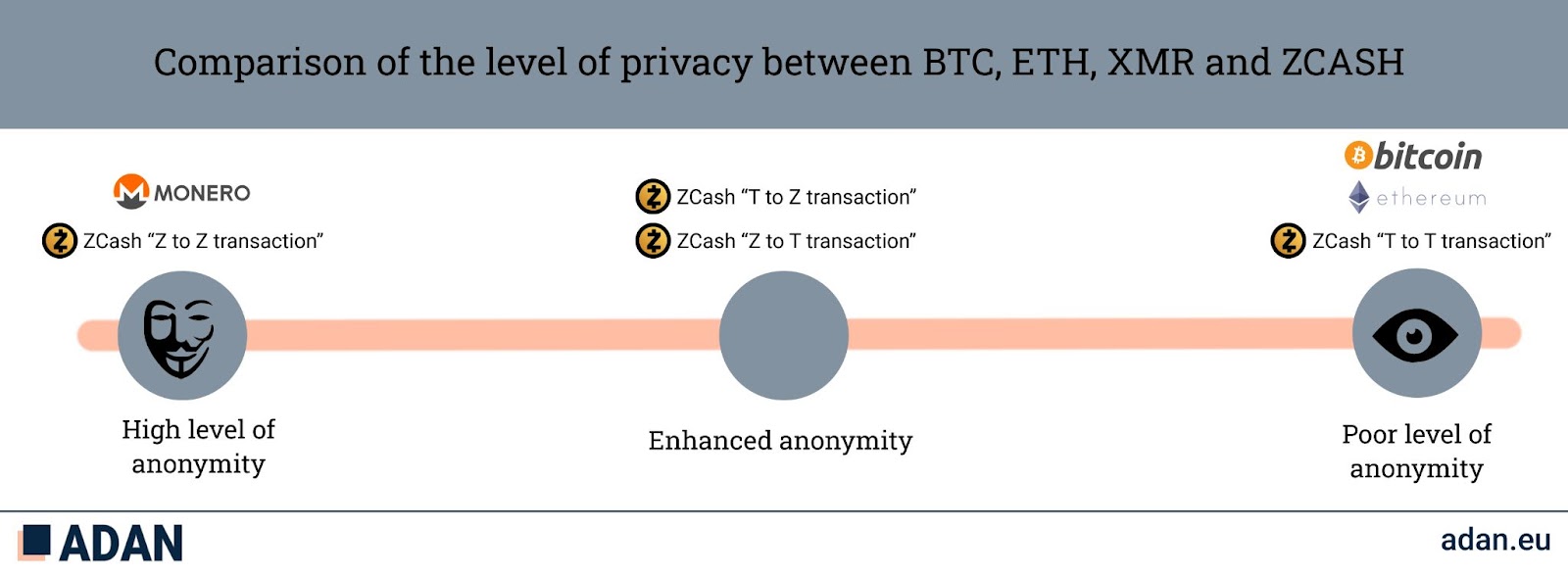

In order to compensate for the insufficient confidentiality of Bitcoin transactions and considering the necessity of preserving the privacy of users, some crypto-assets such as Monero, ZCash, Dash allow for enhanced anonymity of the protagonists of a crypto-asset transaction. There are two categories of anonymous crypto-assets with varying degrees of privacy: privacy coins and anonymity enhanced cryptocurrencies (AEC).

It should be noted that other tools such as mixing services (decentralised or not), or Coinjoin – a method developed by Gregory Maxwell and allowing to mix one’s assets for one’s own account – guarantee the confidentiality of crypto-asset transactions. However, the intrinsic difficulties associated with the use of these tools led to the emergence of anonymous crypto-assets, first with Monero in 2014 and then with ZCash in 2016. These two crypto-assets are the most well-known anonymous crypto-assets within the ecosystem.

Privacy coins

Privacy coins, such as Monero, ensure total anonymity for their users. Monero (XMR) was created in 2014 and is the best-known anonymous crypto-asset in the ecosystem with a market capitalisation of over six billion euros in April 2021. Monero anonymises the value of transactions sent, notably through a system of ring signatures. The ring signature system allows the amount of Monero transferred to be hidden. Then, it allows to mix the public keys of the users in order to hide the address of the sender.

The other main privacy tool used by Monero is the use of stealth addresses. When a user makes a transaction to a public address, the funds are actually sent to an automatically generated stealth address that no independent observer can see. This stealth address is different and unique for each transaction. This mechanism allows the recipient of each transaction to be hidden.

Due to the level of anonymity provided by privacy coins and the resulting risks of BC-FT, some states such as South Korea have the ambition to completely ban the use of these anonymous assets in their territory by the end of 2021.

Anonymity enhanced cryptocurrencies

Anonymity enhanced cryptocurrencies such as ZCash provide optional anonymity to their users.

Like the Bitcoin network, ZCash offers a peer-to-peer network with a maximum supply of 21 million tokens. However, what distinguishes these two networks is the level of customisable anonymity that the ZCash protocol offers. While Bitcoin is pseudonymous in order to offer a compromise between confidentiality and authentication of transactions, the ZCash blockchain allows transactions with a greater or lesser level of anonymity: the network thus distinguishes between private transactions (Z-addresses) and those that are transparent (T-addresses). The ZCash T and Z addresses allow four types of transactions to be carried out with a greater or lesser level of confidentiality.

To ensure this level of confidentiality, Zcash uses the cryptographic method called “zk-SNARKs” (zero-knowledge Succinct Non-Interactive Argument of Knowledge), which makes it possible to prove the possession of a private key, without revealing this information, and without any interaction between the parties to the transaction.

Finally, it should be noted that all transactions made on ZCash remain interoperable, regardless of the level of anonymity included in the transaction

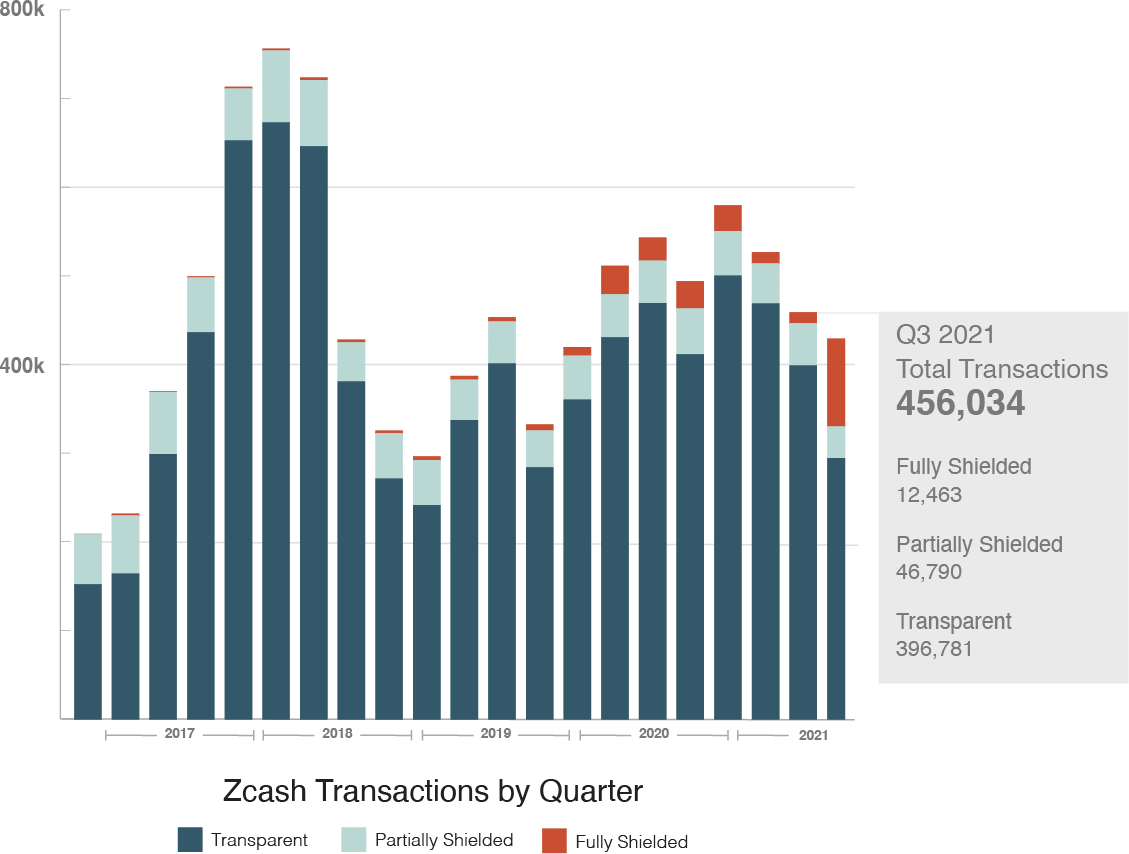

Since 2017, most transactions on the ZCoin network are not anonymous. Indeed, users only use the opportunities offered by the anonymity of ZCoin transactions on an exceptional basis. Nevertheless, it is worth noting that the year 2021 – especially the end of the year – has led to an upsurge in fully anonymous Z to Z transactions.

Anonymous crypto-assets and AML/CFT: undeniable risks

Generally speaking, digital assets – like other industries – present AML/CFT risks that need to be managed and mitigated.

These risks are necessarily increased when a layer of anonymity is added at the time of the transaction. As a result, the risks posed by anonymous crypto-assets – privacy coins and AECs – are tangible.

On this point, the Financial Action Task Force (FATF) has already pointed out in its Red Flags Indicators report that anonymous crypto-assets present a significant AML/CFT risk and require particular attention by providers who offer services on these types of tokens.

In the same vein, the recent opinion of the European Banking Authority (EBA) on the money laundering and terrorist financing risks affecting the financial sector in the European Union recalled the importance of the AML/CFT risks raised by anonymous crypto-assets.

These pronouncements are not insignificant. Indeed, even if few funds are laundered in the digital asset sector, several money laundering cases in the sector have involved anonymous crypto-assets.

Conclusion

Given the low level of privacy provided by traditional crypto-assets such as bitcoin or ether, anonymous crypto-assets tend to guarantee the user’s right to privacy – an intrinsic human right. In sum, the usefulness of anonymous crypto-assets is clear: they offer the right for a user to disclose – or not – the destination of his funds and the amount of his transaction to other users of the network. Anonymous crypto-assets are de facto an important vector of freedom in the digital age, the freedom to disclose one’s wealth and interactions with other users of a blockchain network.

However, this anonymity is also synonymous with risks. Some ill-intentioned users could take advantage of the opaque nature of transactions made via these assets to launder their ill-gotten gains, or even worse, to finance terrorist operations. In this context, it is essential to promote tools that make it possible to trace suspicious transactions made via anonymous crypto-assets and to regulate them. This is what transactional analysis companies such as Chainalysis, Scorechain and Elliptic are trying to do.

These risks remain to be qualified: the amount of funds laundered through crypto-assets has been estimated at $1.9 billion in 2020, which represents only a tiny part of the $3,000 billion capitalisation of the crypto-asset market.