Research

Crypto-assets in France – State of play and assessment of the ecosystem – 2020

In 2011, the genesis of the French digital asset industry took place – with the launch of France’s first exchange platform. The year 2020 marks the structuring of digital asset professionals around a new association: the Adan. To date, the Adan brings together 50 companies operating a wide range of activities.

Today, there are between 80 and 100 companies specializing in the digital assets sector in France, mainly VSEs and SMEs. Growth is sustained. The dynamism of the market is also illustrated by the youth of the companies: more than 70% of Adan members were created during or after 2018.

The adoption of crypto-assets by the French public

The study “Les Français et les nouveaux moyens de paiement” (“The French and new payment methods”) conducted by the CSA Institute, Ekino, EY, Global P.O.S. and Smartchain published in January 2020 shows that 74% of the French are familiar with “cryptomonnaies”, 13% of them say they are familiar with how they work and 23% feel well informed. 5% have already bought one, and 12% would be interested in buying one. 19% would be ready to pay for their purchases with them, and 44% of 25-34 year olds would be encouraged to go to the stores that offer them.

A Coqonut study published in July 2019 estimates the number of crypto investors worldwide at between 51.2 million and 52.4 million, of which 900,000 are French investors (approximately 1.70-1.75%). According to the company, which is currently working to update its study, the order of magnitude remains very similar to the summer of 2020.

A study by the Cambridge Centre for Alternative Finance, published in September 2020, counted the total number of accounts opened with a digital asset service provider at more than 191 million, among which the identity of 101 million of these users could be verified (an increase of 189% in one year).

Using the customer information available thanks to the services provided by Coqonut (portfolio monitoring and tax declaration), an average portrait of the French “crypto-trader” could be drawn.

Regarding the investor profile:

- The 25-45 age group accounts for half of French investors, which is corroborated by the CSA study which reports that 25-34 year olds are the most knowledgeable about these new assets: 13% have already acquired them and 23% would like to buy them;

- 90% of them are male;

- They are evenly distributed throughout France.

Regarding their portfolio:

- 1.2 different digital assets in the portfolio on average;

- 250 in terms of median amount invested. At Coinhouse, the average amount invested by its clients is 2,700 euros;

- Less than 10% of investors hold more than 0.5 bitcoin, in a portfolio with an average of 20 digital assets. These investors use an average of 3 platforms in their trading activity. At Coinhouse, 2% of clients trade more than 30,000 euros.

According to the index developed by Chainalysis to measure the level of adoption of crypto worldwide, France has a relatively low score of 0.2 on a scale of 1, although it ranks 21st (out of the 154 countries in the index) behind the United States, China, the United Kingdom and Australia. In Europe, however, France is doing very well and ranks first on the podium of Northern and Eastern European countries in terms of value received “on-chain” (more than $7.5 billion) – the 11th highest in the world. In terms of peer-to-peer trading volume, France ranks 14th in the world.

State of the French digital asset industry

Digital assets are becoming firmly established in the French landscape, thanks to the development of its industry and the support of a growing number of citizens…

An already well-established and ambitious French crypto industry

Through its own members, the fabric of French digital asset companies is perceived as dynamic, well positioned in the European “race”, and with strong, cross-border ambitions. The construction of this industry also seems to be based on values of collaboration and caring for others. This situation and state of mind, reinforced by the creation of the Adan in early 2020, seems to favor faster progress on many issues.

The dynamism and strong voice of this industry also promotes dialogue between the private and public sectors, which is intensifying and diversifying on the various issues encountered by the players.

Finally, the dynamism and ambition of crypto companies is a real engine for growth, at a time when the French economy needs to find a new lease of life in the post-crisis period. The digital assets segment is indeed a promise in terms of job creation (the world’s largest exchange platforms currently employ up to 5,000 people) and the modernization of certain sectors such as banking, law, compliance and research, thanks to the breeding ground of recognized experts in the field (researchers, engineers, developers, etc.).

An innovative regulatory framework that has attracted the attention of foreign players

The forward thinking of the French public authorities on the regulation of digital asset markets and the implementation of the PSAN regime, which was a first for a G20 country, has led foreign players to take an interest in the French crypto industry. For example, the first edition of the Paris Blockchain Week Summit in April 2019 was covered by many international media, such as Reuters, CNN and Forbes. The regulatory context has decided some foreign companies to launch their activities on the territory – an ongoing process noted by several Adan members. However, it should be noted that these projects are above all the opening of a new market for foreign players and that the jobs, income and intellectual property of these players are generally destined to remain located in their home countries.

A strong resilience of the industry, especially in the current health and economic context

The COVID-19 crisis has impacted all sectors of the French economy, including that of digital assets. However, while the impact on financing, economic activity and the projects of the players is negative overall for the industry, the overall impact of the economic situation is less gloomy.

On the one hand, the players were able to exploit the opportunities arising from these special circumstances. Indeed, the crisis has highlighted flaws in the current system, promoting the blockchain products and services offered within the French ecosystem (including digital assets) and the emergence of new solutions. In addition, the crisis has uncovered new underlying trends and long-term prospects for a profound transformation of the economic and financial system. This movement includes the rise of decentralized finance, as well as the adoption of a system of values – centered both on respect for individual privacy, corporate social responsibility and transparency – of which blockchain technologies and digital assets can form a foundation.

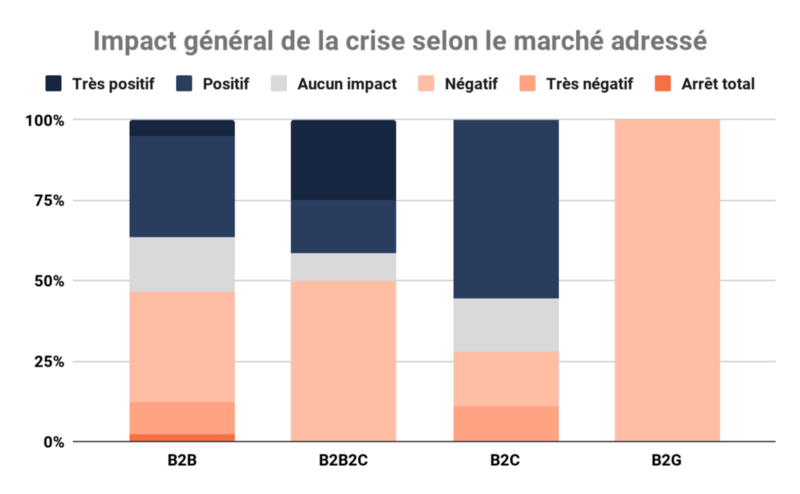

On the other hand, in line with this favorable environment, a stronger democratization of digital assets has been initiated. Indeed, the economic crisis has given digital assets a new prominence, which has led the general public to take an interest – or even a renewed interest – in these assets (see below). This is why the B2C segment of the crypto/blockchain business has withstood the crisis much better than the B2B and B2B2C businesses, and has even grown and continues to grow – driven by the bull market of the summer of 2020. B2C players have thus noted a strong expansion of their customer base.

Growing democratization, supported by the crisis, blockchain technologies and digital assets

There has been growing public interest in digital assets over the years, with a strong acceleration in recent months. Indeed, the financial crash of 2020 has elevated digital assets to the status of credible diversification assets, and a growing number of investors – companies and individuals – have included them in their portfolios. At the same time, the attendance of specialized online media, as well as participation in webinars on blockchain technologies and digital assets, has increased significantly. This also helps to explain the continued activity of certain players, supported by the arrival of this new target group of users.

… But there are still barriers to the adoption of digital assets and the development of their markets.

A lack of attractiveness and competitiveness of the French crypto marketplace: a threat to the ecosystem

The French industry is suffering from a lack of attractiveness and competitiveness on the international market. We regret that this is a problem that is not a priori dealt with much in the reflections and mandates of the French authorities.

On the market infrastructure side, France is the great absentee of the world chessboard without any champion at this stage in the field (exchange platform, broker): the liquidity of the digital asset markets is elsewhere and mainly in US and Asian jurisdictions. Some contenders have the potential to become strategic players, but lack support. Yet this market infrastructure is a strategic element for the French crypto ecosystem, in the same way as Euronext is for the financial marketplace. This is why their development must be encouraged by the public authorities, otherwise they will continue to be totally dependent on the market infrastructures of foreign countries.

Concerning the asset management industry, the majority of funds are located outside France (British Virgin Islands, Cayman Islands, Delaware, etc.). This is due in particular to the large number of providers specializing in the sector (audit, custody, banking, law firms, etc.) present in these territories, and to the turnkey offers available. Some French investors are trying the club deal, but this vehicle is not attractive because of the applicable tax regime (corporate tax and not the tax regime adapted to investment funds), which is why the amount of assets under management remains extremely low at this stage.

Finally, foreign companies are discouraged from setting up their projects in France, as they cannot use the services of local banking institutions – even though they are subject to regulation (see below). The majority of companies operating in Asia or North America therefore choose Estonia, Lithuania or Malta to launch their European business.

This is why, if the French crypto industry is in the race, it is a marathon: its positioning on an international scale cannot be based solely on its dynamism and requires increased support from public authorities.

Funding: the crossroads of digital asset players

For the French crypto industry, finding financing is very complex. Indeed, France does not have private and public venture capital funds, nor does it have a source of funding for major projects that can finance these infrastructures and support the ecosystem. The “Global Report H1/2020” by CV VC and PwC Switzerland shows the total absence of venture capital funds invested in the blockchain segment.

However, without this essential financial support at the different stages of growth (seed/priming, early stage and late stage), the players’ development is considerably slowed down or even totally blocked.

The nonsense of the “blockchain made in France”.

In France, there is a strong desire to create closed, private blockchain environments, or blockchains linked to groups of players or use cases. This approach does not seem relevant to the Adan members, who evoke a parallel with the creation of a minitel for transport in Alsace or luxury in Aquitaine, when the Internet would already allow everyone to access a more advanced technology.

This typology of projects demonstrates the willingness of some players to maintain total control over a system that should be able to operate without an identified trusted third party in order to achieve its full potential. A sometimes confused discourse around digital sovereignty – which does not take into account the open, open source and public nature of infrastructures – contributes to the confusion.

A common and public network where everyone can only be a user – a public and open blockchain – should therefore be favoured whenever possible. There are many advantages attached to the use of these systems; in particular, they allow a large group to use SaaS-type blockchain solutions, so without a long infrastructure deployment process (which is then public, like the Internet), and without maintenance and installation costs, while lowering the barrier to entry: it is possible to use solutions addressed to a business, without the need to build up expertise in blockchain technology. These SaaS blockchain/business solutions are developing and are successful, but are still quite rare in France (e.g. Ownest, Arianee, Ark).

Resilience to the COVID-19 crisis that did not rely on the support of the State and banking institutions

While the French digital asset industry has so far managed to overcome the COVID-19 crisis, the economic support measures put in place by the government have provided only limited support to the players.

The Adan study on the state of the crypto/blockchain industry during the COVID-19 crisis thus highlighted the fact that the players who sought help from the State and banking institutions very rarely obtained satisfaction. Concerning aid dedicated to start-ups, nearly 89% were refused or not processed. Concerning help granted to companies, a third of the requests from crypto players were not processed or satisfied.

This conjunctural observation echoes structural obstacles that are by no means new (see below).

Difficult relations between the crypto and banking industries that persist

The crypto actors have always experimented a difficult communication with the banking establishments within the framework of their steps and the traditional negative a priori with regard to their activity.

Since the creation of the blockchain and the first entrepreneurial projects in France, and despite intense discussions and educational efforts, digital asset players have been unable to build relationships of trust with the banking sector. These difficulties are materialized both by the almost systematic refusal to open an account for these new entrants and to provide them with credit or payment services, and by the obstacles placed in the way of their customers who would like to use “crypto/blockchain” services. According to the results of the survey “Banks and their users with respect to cryptocurrencies” conducted by the CryptoFR Association, 35% of users of digital assets experience difficulties with their banks in order to acquire them (by credit card and/or bank transfer).

Indeed, French banking institutions still refuse to provide their services to crypto companies, or seize the first opportunity to break off all relations with the players, despite the introduction of the enhanced account right for registered and approved PSANs, which has not changed the situation (see below). A recent Adan survey provides a statistical diagnosis of these obstacles: 50% of the players have experienced difficulties opening their current bank account, 68% have been refused (once or several times).

This situation jeopardizes the development of the French digital asset industry.

On the one hand, it risks, in a relatively short period of time, pushing the players to establish themselves abroad. According to the aforementioned survey, 64% of French crypto professionals are considering relocating their activity and 85% report that relations with banking and financial institutions are less difficult in other European Union countries. This risk has already materialized for many entrepreneurs in the ecosystem, who are already expatriated to other European countries (mainly the United Kingdom, Germany, Switzerland and Portugal).

On the other hand, the consequences of this non-banking proved critical in the recent context of the COVID-19 crisis, when crypto actors could not benefit from certain economic support measures (such as the EMP) due to the absence of a bank account and because of the difficult communication with the institutions.

A laborious implementation of French regulations, which does not help to improve the situation.

While the PSAN regime was aimed in particular at calming relations between the crypto and more traditional industries, and granting registered or approved players a stronger right of access to the account, it must be said that the eighteen months since the implementation of this scheme have not helped the players. To date, only two PSANs have been registered and none is accredited. And this is not a problem of demand. The time it takes for the regulatory authorities to process the files is considerable, while the players have a pressing need to prove their credibility – which is what PSAN status would grant them.

Moreover, for registered PSANs, initial evidence shows that the promise of registration is not being kept. On the one hand, to date it has not led to improved relations with French banks. On the other hand, the status of PSAN is not valued in the search for financing.

Finally, as currently drafted, French regulations do not capture foreign players who may continue to address the French market without complying with the conditions applied to French companies that – for the same activity – must register.

Sales promotion channels closed to digital asset players

French players in digital assets face discriminating obstacles when they want to launch marketing campaigns using the tools offered by the “GAFA” (Google, Amazon, Facebook and Apple).

Indeed, to date, no French player has managed to use the Ads services of these BigTech.

- the “products and services of cryptocurrencies extraction”, but under numerous conditions: the customer’s explicit consent has been obtained, the provider is certified (which makes no sense under current regulations, which do not provide for such certification), and Google has certified the provider’s account.

- “cryptocurrency exchange platforms”, but only in the United States and Japan. It is therefore impossible for French platforms to promote their services in France to the French public.

In addition, the following are explicitly refused, and may not benefit from Google Ads services: any promotion of offers to the public of crypto-assets, any buy/sell and exchange of crypto- assets that fall outside the scope of the “cryptocurrency exchange platforms” defined above, crypto-assets custody portfolios, investment advice on crypto-assets, as well as other market information services such as the provision of trading signals or “broker reviews” (“financial” analysis).

To date, all crypto players have been refused when they have contacted GAFA companies in order to understand their refusal to offer their services.

Persistent bad image with certain authorities due to preconceived ideas

The aforementioned obstacles are exacerbated by the lack of positive communication on the part of the French authorities. Indeed, the actors deplore the negative preconceptions that have been conveyed for years, but which still underlie some of the public statements made by decision-makers, even though great efforts have been made to deconstruct them. This is severely damaging the influence of the actors and contributes to maintain the climate of distrust of traditional industries towards the crypto world. This contrast with the creation of a regulation (theoretically) rather favorable to innovation is difficult to understand by digital asset professionals.

Taxation of digital assets: a hindrance to adoption

The taxation of digital assets in France hinders the acceptance of their holders and potential users. These difficulties are diverse in nature: a very complicated tax calculation mechanism, changes in methods between 2018 and 2019, regularizations, a level of declaration that is still very far from that of traditional assets, etc.

Many grey areas need to be removed: the management of staking or savings income, the management of leveraged operations, digital asset lending, the processing of credit card transactions on digital assets, and so on.

Conclusion

The development potential of the digital asset markets in France is enormous – notably thanks to the progress already made since the discussions on a PSAN regime. The industry presents undeniable opportunities for the economy, employment and national digital sovereignty. However, there is still a long way to go: perhaps there is a lack of strong political will to give the players all the cards they need to overcome the persistent blockages they face, and to establish themselves in the international game as the serious competitors they have the potential to become.

The Adan (Association for the development of digital assets) brings together digital asset and blockchain professionals in France and Europe. Its members cover a wide range of activities: markets, preservation, payments, management, analysis tools, project and user support, security, etc.

Adan’s mission is to federate the digital assets industry and promote its development in the service of a new digital economy. To do this, the Association has technical and regulatory expertise in the world of digital assets and maintains a close dialogue with public authorities and associations.

Thanks to those who contributed to the writing of this article: Quentin de Beauchesne (Ownest), Nathan Benchimol (Just Mining), Patrick Bucquet (Coqonut), Adrien Hubert (Smartchain), Nicolas Louvet (Coinhouse and Coinhouse Custody Services), François-Xavier Thoorens (Ark Ecosystem), Alexandre Stachtchenko (Blockchain Partner), Zahreddine Touag (Woorton), Willem Van Den Brandeler (Chainalysis) and Oliver Yates (Sheeldmarket)