Research

Non-fungible tokens (NFT): digital scarcity

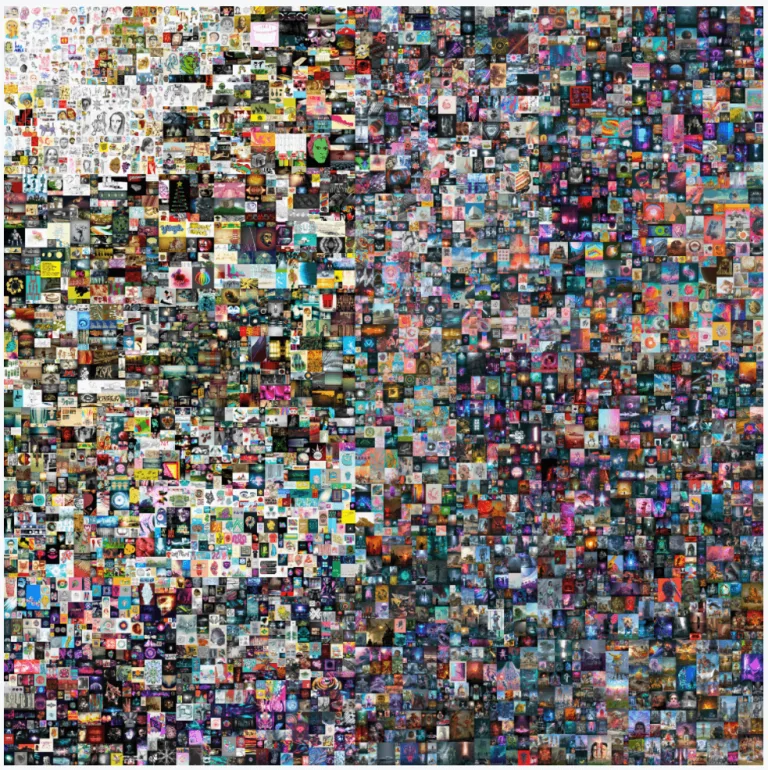

“EVERYDAYS : THE FIRST 5000 DAYS”, Beeple

On 11 March 2021, the digital work “EVERYDAYS: THE FIRST 5000 DAYS” by the American artist Beeple was sold for $69.3 million by Christie’s auction house. This record-breaking sale places Beeple among the world’s most expensive artists and illustrates the revolution in the art sector brought about by NFTs (non-fungible tokens).

These non-fungible tokens, which have recently gained remarkable public attention, are not simply limited to the artistic domain. Numerous use cases are emerging every day in video games, sports, luxury goods, music (and more) to record proof of ownership of a unique asset in the public registry of blockchain networks – immutable and unforgeable.

This article aims to draw attention to this revolution orchestrated by the NFT market – a multi-sector revolution that puts digital scarcity at the heart of innovation in the crypto-asset sector – and to explain the underlying technological underpinnings.

At the same time, NFTs raise issues of legal qualification that need to be resolved in order to create more confidence for investors and allow the emergence of new innovative projects.

Definition

Broadly speaking, an NFT can be defined as a unique token, certifying the ownership of an asset – material (artwork, real estate and the like) or digital (collectibles, digital avatars, digital artworks and the like) – to its holder and registered on the public blockchain registry. To date, most NFTs are issued via the Ethereum network. The NFT is usually accompanied by information about the author of the work, the previous owner and other more technical terms inherent in the underlying asset.

NFTs are unique. Protocol tokens, like bitcoin and ethereum, are fungible and interchangeable. Unlike these crypto-assets, NFTs are so unique that it is not possible to exchange one NFT for another NFT of the same value (in the same way as a recognised painting or a particularly rare bottle of wine).

NFTs are indivisible. Most protocol tokens are divisible by their holders. For example, 1 bitcoin is divisible up to 100 million satoshis (the smallest unit of account in bitcoin). This is not the case for NFTs, which cannot (in principle) be divided into multiple units due to their uniqueness.

Ultimately, NFTs play a central role in bridging the digital and physical worlds. They can be easily exchanged without a trusted third party thanks to blockchain networks and can be stored securely on a crypto asset portfolio for life.

Chronology

The beginnings: 2012 – 2016

Colored Coins. Colored coins emerged in 2012 due to the need to represent certain assets on the Bitcoin network for different types of financial transactions. These colored coins use the partial fungibility of Bitcoin (traceable through blockchain technology) and present themselves as a metadata overlay to associate real assets (stock, bond, real estate, commodities, etc.) with Bitcoin addresses.

The Counterparty platform. Counterparty is a platform built on the blockchain and the Bitcoin network. Counterparty was one of the best known platforms in 2014, along with Mastercoin, Ethereum and Ripple. It was a “metacoin” protocol in which new features could be associated with bitcoin tokens to make them unique. The platform provided features such as user-created currencies, additional financial instruments and a decentralised asset exchange.

The Rarepepes project. The Rarepepes project was initiated in 2016 with the aim of creating a digital edition of collectible images of the character Pepe the frog. The project has been very successful, with some cards being directly created by renowned artists.

The advent: 2017 – 2019

The Cryptopunks. Cryptopunks are among the main NFTs to have driven modern crypto-art. Created by Larvlab in 2017, CryptoPunks are akin to 10,000 characters uniquely generated by an algorithm on ERC-721 tokens (i.e., Ethereum blockchain compatible tokens. Initially, these cryptopunks could be obtained for free, but the project has subsequently grown in popularity. Now, four years after their creation, Cryptopunks are sold for an average of 15.45 ethers.

Source: LarvLabs

CryptoKitties. The CryptoKitties project is a blockchain game on Ethereum developed by the studio Dapper Lab in 2017. This game allows its users to buy, collect, breed and sell tokenised virtual cats. Like Cryptopunks, the popularity of the game has led to a sharp rise in the value of these NFTs, with some CryptoKitties selling for up to 600 ethers.

In addition, this period saw the emergence of the first exchange platforms dedicated to non-fungible tokens, such as Opensea and SuperRare. These trading platforms have particularly improved the liquidity of the secondary market for NFTs by allowing any holder of an NFT to deposit his or her assets at auction.

Mass Adoption: 2020 – Today

The year 2020 saw the emergence of a variety of new projects, with some transactions reaching very large amounts. This demonstrates the massive adoption and diversification of the NFT market.

This growth in the NFT market has undoubtedly been driven by the significant growth in the crypto-asset market in 2020 and 2021.

In addition, the Covid-19 crisis, which has led to a sedentarisation of populations around the world, has facilitated the adoption of these non-fungible assets. In the art sector, some artists have used blockchain networks as a medium for their work due to the closure of museums and galleries. This massive adoption has led to a large valuation of the NFT market – as of August 17, the total valuation of the crypto-art market was estimated at $759 million – and historic auctions for the crypto-asset industry. As an example, ten digital works by Canadian musician Grimes were sold on the specialist platform Nifty Gateway for $6 million last March.

The frenzy around the NFT market is such that the sale of certain assets has been the subject of debate within the industry. For example, the famous meme “disaster girl”, a must-have on the web, was sold last April for 180 ether by its author. These sales are considered by some to be purely speculative and of no real economic interest. Some people even use these sales to put forward the idea that the explosion of the NFT market is only temporary and will not revolutionise the myriad of sectors it concerns.

Moreover, the last few months have led to an explosion of metaverses, notably due to Mark Zuckerberg’s announcement that the Facebook brand will now be renamed “Meta”. Metaverses are fully virtual worlds adopted by communities of users represented as virtual avatars that can move, interact and exchange digital value.

Operation

As most NFTs are issued from the Ethereum blockchain, a significant proportion of NFTs in circulation are based on the ERC-721, ERC-1155 and ERC-998 standard.

ERC-721 tokens

The ERC-721 (Ethereum Request for Comments 721) was conceived by William Entriken, Dieter Shirley, Jacob Evans, Nastassia Sachs in 2017. It is a standard to put into circulation unique and non-consumable tokens valued by their rarity and/or originality. Unlike the classic ERC-20 tokens, ERC-721 tokens are indivisible (it is impossible for two addresses to hold the same Cryptokittie in equal parts) and cannot be destroyed.

To date, more than 15,000 ERC-721 tokens are listed on the Ethereum network.

ERC-1155 tokens

The ERC-1155 tokens are so-called semi-fungible tokens proposed by Witek Radomski, Andrew Cooke, Philippe Castonguay, James Therien, Eric Binet and Ronan Sandford. These standards allow users to register fungible (ERC-20) and non-fungible (ERC-721) tokens using the same address and smart contract.

The ERC-1155 supports the transfer of multiple types of tokens at once, saving on transaction costs. Trading of multiple tokens can be built on top of this standard and it eliminates the need to “approve” individual token contracts separately.

Les jetons ERC-998

ERC-998 tokens are akin to composable NFT standards. Proposed by Matt Lockyer, Nick Mudge and Jordan Schalm in July 2018, the ERC-998 can hold both unique non-fungible tokens (such as the ERC-721), as well as uniform fungible tokens (such as the ERC-20). The ERC-998 token can then be evaluated and exchanged.

ERC-998 is an extension of the ERC-721 standard that adds the ability for non-fungible tokens to own other non-fungible tokens and ERC-20 tokens. The non-fungible tokens that implement ERC-998 also implement ERC-721.

NFT and decentralised finance (DeFi)

NFTs and the decentralised finance sector (DeFi) are beginning to interact with each other in several interesting ways.

The use of NFTs as collateral for loans

When a user of a crypto asset lending protocol attempts to take out a loan, the user may not have the funds in crypto-assets to provide sufficient collateral for the loan and prevent counterparty risk.

In response, projects such as NFTfi allow borrowing funds in crypto-assets by using NFTs as collateral for loans.

Improving market liquidity through fractional NFTs

Nftfy or DaoFi, on the other hand, offer NFT holders a service that allows non-fungible tokens (ERC-721) to be split into fungible shares (ERC20). As with financial products, the shares can be traded with each other or against other crypto-assets on secondary markets. This is intended to create liquidity for these often illiquid products. For example, one could imagine that the owner of “Everyday: the First 5,000 days” could split his NFT in order to sell shares, for those who wish to own part of this work for collection or investment purposes.

The problem of liquidity in high-value NFTs is addressed by these projects by linking to existing DeFi protocols. In order to sell these shares, it is suggested to create liquidity pools on the most known DeFi platforms like Curve or Uniswap where other collectors/investors can come and buy shares of the fractional NFT.

This is technically possible thanks to the ERC 1155 standard. Fractionalisation occurs when the NFT holder locks the NFT into a smart contract while the shares are created. The NFT can be recovered provided that the claimant owns all the existing shares associated with the NFT.NFT creators can also create “shares” for their NFT. This gives investors and fans the opportunity to own part of a valuable NFT. Fractional NFTs therefore offer new opportunities for issuers and collectors.

These fractional NFTs can be traded on decentralised trading platforms such as Uniswap, as they will be offered for sale at a fixed price by the issuer.

These NFTs would then make it possible to possess the pixels of a rare photograph or a tiny part of a Van Gogh painting.

Some even consider that it will eventually be possible to be part of a decentralised autonomous organisation (DAO) to manage the entire asset when one holds a fraction of the non-fungible asset.

Use cases related to NFTs

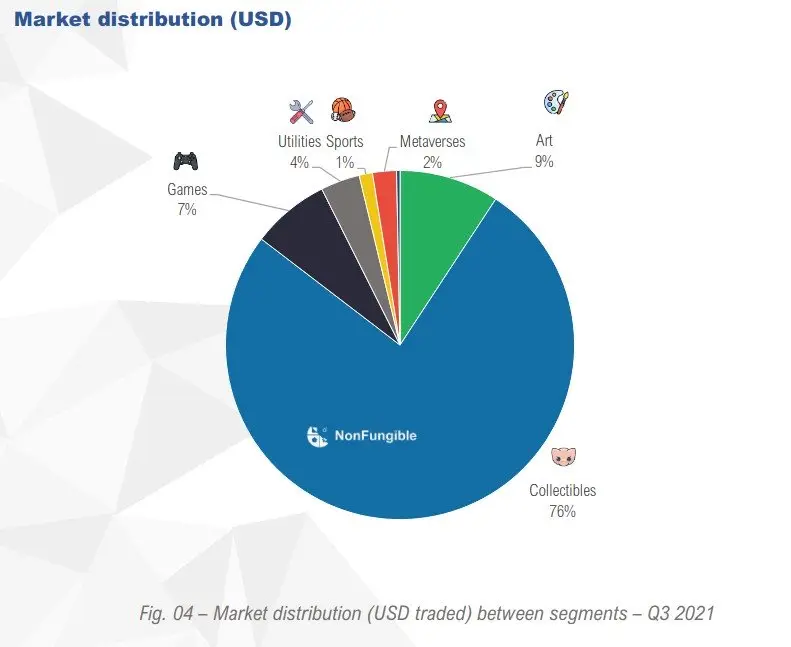

NFTs offer a wide range of use cases, to date most of the current supply of non-fungible tokens is in the form of collectibles. However, the market could diversify considerably in the future. It is therefore appropriate to consider – without being exhaustive – the main use cases for NFTs.

Source : Nonfungible.com

In the cultural sector (art, music)

Art is the area in which non-fungible tokens have become known. An NFT allows any digital object to be stored on the blockchain: an image, a GIF, a video, or a clip. NFTs have enabled artists to offer their work in a new form – exclusive and digital.

In March 2021, the music group Kings of Leon released their album via NFT, a first.

In the video game sector

NFTs first attracted attention in the field of games, in particular collectible games. Subsequently, many NFT projects emerged in the video game sector until the video game sector became one of the main use cases for NFTs.

Many NFT projects have developed around collectible card games inspired by more traditional card games such as Pokémon or Hearthstone.

In addition, NFT gaming projects have often developed around open worlds or metaverse. The best known project is Decentraland, launched in February 2020, the project brings together a large community within a metaverse. Last June, a plot of land was sold for $913,808 by a user of the game.

More recently, a trend allowing players to play NFT games has gradually developed: “play to earn”. Following the example of the Axie Infinity game, players can earn – by accumulating experience in the game – tokens (such as the SLP in Axie Infinity), thus generating income in crypto-assets as one plays the game.

In addition, several traditional video game companies are developing their future projects around NFTs. In France, Ubisoft has partnered with Sorare to develop a free football game called One Shot League.

In the real estate sector

NFTs also have potential in the real estate sector. In the United States, an individual tokenised part of his house and put it up for sale on the Mintable platform.

In the luxury sector

In the luxury sector, NFTs could act as a certificate of authenticity for the luxury item. Linking editions of rare objects to private keys would authenticate each object and thus limit the risks of theft (each transaction being traceable on blockchain networks) and counterfeiting.

In France, the Arianee project allows a luxury product to be associated with its own unique and unforgeable digital passport. This digital passport represents the secure, anonymous and transferable exchange channel between the brands’ products and their owners.

NFT and physical goods

Although the success of NFTs is proof of the potential of blockchain technology, in terms of the immutability of transaction records, as well as proof of ownership, their use today is limited to the digital world. Although many aspects of our lives have migrated into this realm, there is a temptation to forget that the most valuable assets are in the physical world around us. After this reflection and contextualisation, we see that non-fungible token technology would also have an application in the physical world. Indeed, NFTs could be used to guarantee the authenticity, the proof of ownership of physical goods in general. Whether it is art, luxury goods or collectibles, with physical products, we would return to a model that guarantees the uniqueness of products.

However, unlike digital assets, physical NFTs face complex practical engineering issues. How do you associate a physical product with an NFT on the Blockchain, all in a secure and tamper-proof manner? QR codes, signatures, unique packaging. The techniques are diverse but raise questions, particularly with regard to product security and counterfeit prevention.

Beeple, best known for its “everyday’s work”, has started selling physical NFTs. “Human One” is a two-metre sculpture, coupled with four screens, broadcasting the NFT in video format. This work stands out thanks to the playful and innovative way in which we interact with the work. In this case, the authentication of the product is done thanks to the unique packaging and shape.

Other projects are turning to certificates of authenticity to authenticate a physical NFT. In the art industry, projects such as verisart or concept.xyz create a certificate of authenticity of the physical good. The document attesting to the authenticity of the product is in turn stored in the NFT, secured by the blockchain.

Finally, projects such as Mattereum or Niftify propose another approach for their B2C service allowing the purchase of NFTs associated with physical goods. Indeed, these goods remain in the possession of the company while the owners hold the associated NFTs, allowing a simplified and 100% digital commerce thanks to the NFT. Transactions can now be dematerialised as many times as desired, while taking advantage of blockchain-based transaction security. Once the owner decides to reclaim the physical goods, the company will “burn” the NFT in order to return the physical good to its owner. Thus, the company assumes the role of a trusted third party to guarantee the authenticity of the product.

Fractional NFT

The immutable and secure aspect of an NFT registered on a blockchain guarantees proof of ownership but does not solve all the problems for those who consider them as investment products. One of the big problems for these investments is the lack of liquidity. As with works of art, the high price presents a fairly high barrier to entry. DAOs (Decentralised Autonomous Organisations) present themselves as a solution to this problem, although acquisition can now be done in a group, organised by voting.

Therefore, several projects present a new method of operation: NFTs (Fractionated NFTs). Again, several approaches exist to split NFTs.

Fractions of NFT Physics.

Sygnum Bank, the owner of the painting named “Fillette au béret”, by Picasso, recently split the physical artwork estimated at USD 3.68 million. The shares, valued at USD$ 6,000 were sold by SygnEx, the Swiss digital asset trading platform.

In both cases, the goods associated with the NFT remain in the possession of the company that manages the physical goods. As a result, the third party company holding the product ensures the authenticity of the asset associated with the NFT through the attached certificate of authenticity.

In addition to facilitating transactions in these products, the advantage of this technique is that it allows investors to invest in goods or products that are sometimes very valuable. These shares can then be sold on the NFT marketplace.

The legal nature of NFTs : a legal uncertainty

To date, although NFTs have attracted the attention of most legislators, they are not the subject of a specific regulatory framework. Trivially, two hypotheses seem possible for the French legislator.

Assumption 1: NFTs are treated as digital assets

Qualifying NFTs as digital assets would make it possible to treat NFT service providers as PSANs (digital asset service providers). Depending on the services offered, NFT project sponsors would be required to register with the AMF with the approval of the ACPR, pursuant to Article L. 54-10-3 of the Monetary and Financial Code.

Such an assumption would imply that most NFT projects – trading platforms such as Opensea – would have to put in place an anti-money laundering and anti-terrorist financing framework.

However, such a qualification should not require NFT issuers to obtain a regulated status, as long as they merely sell NFTs and do not seek to provide additional services (e.g. creation of a platform on which NFTs will be deposited, organisation of a secondary market on a dedicated platform, etc).

2nd Assumption: NFTs are not assimilated to digital assets but to the underlying asset

If NFTs are not assimilated to digital assets, one could consider assimilating them to the underlying asset. From this perspective, some NFT service providers would be qualified as intermediaries in various goods within the meaning of Article L. 551-1 of the Monetary and Financial Code. This article already applies to sales of works of art (paintings and sculptures) and collectors’ items.

Indeed, NFTs, due to their great diversity, could be associated with the asset underlying the token, representing a movable or immovable, tangible or intangible property according to the provisions of the Civil Code.

From a tax point of view, if one follows such a legal analysis of NFTs, the gains obtained from the sale of NFTs would be subject to the regime of capital gains on movable property with a tax rate set at 36.2% and an exemption for any sale of NFTs for an amount of less than €5000.

Conclusion

Since 2020, the NFT sector has been undergoing massive adoption. Adoption is still in its infancy. And while the sometimes high amounts resulting from NFT sales may have been the subject of unwelcome controversy, the technology underlying these assets is already fully functional and new use cases are emerging day by day, diversifying the crypto-asset industry considerably.

It goes without saying that the democratisation of the NFT market is inevitable. To facilitate this democratisation, efforts remain to be made on the one hand in terms of education, users and traditional players must gradually take hold of this technology by studying all the opportunities offered by NFTs, and on the other hand, in terms of regulation, NFTs will ultimately have to be the subject of a clear framework to establish a climate of confidence and security for investors.