Research

Stablecoin Conference: Growing interest in the topic of digital currency transformation

On 23 April, Adan organised a conference in collaboration with the LaBChain consortium (Deposits and Consignments Fund) on stablecoins and the digital transformation of money. Stablecoins, crypto-assets with a stable value that compensate for the volatility of more well-known assets such as bitcoin, present various issues for the crypto-asset industry and public authorities who consider these stablecoins to be an issue of monetary sovereignty.

Many speakers followed one another during this conference, in order of intervention: Faustine Fleuret (Director of Strategy and Institutional Relations, Adan), Bernard Stede (Blockchain & Cryptoactives Project Manager, CDC), Sébastien Couture (Communications Director, Adan), Mounir Benchemled (Founder, ParaSwap), Xavier Lavayssière (ECAN, Paris 1), Pierre Person (Deputy of Paris), Nadia Filali (Director of the Blockchain & Cryptoactives Programme, CDC, and LaBChain Consortium Leader), Olivier Ou Ramdane (Co-founder, Lugh), Christian Pfister (Directorate-General for Financial Stability and Operations, Banque de France), Grégory Raymond (Journalist, Capital – Newsletter 21 Millions), and Roxane Faure (Blockchain Project Manager, Digital Transformation Department, CDC).

“The goals for digitising the euro are to create digital value on-blockchain, provide new payment solutions, improve financial inclusion and enhance the programmability of the currency.” Bernard Stede

After a short introduction to the conference, the first speech allowed Bernard Stede to present the concept of stablecoins generically.

According to Bernard Stede, there are three types of stablecoins aimed at digitising the Euro: central bank digital currency (CBDC), commercial bank digital currency (CBDN) and private initiative digital currency (PIDN).

Many states are interested in and working on MNBC projects. The most advanced projects are in countries where financial inclusion falls behind European standards. Bernard Stede highlighted United States’ dominance in the creation of private initiative stablecoins (Tether, USDC, etc.). In France, the Lugh (EURL), the first French stablecoin backed by the euro, has recently been launched.

“Stablecoins are a valuable tool for the unbanked.” Sebastien Couture

Following this general presentation, Sébastien Couture gave an overview of the stablecoin ecosystem.

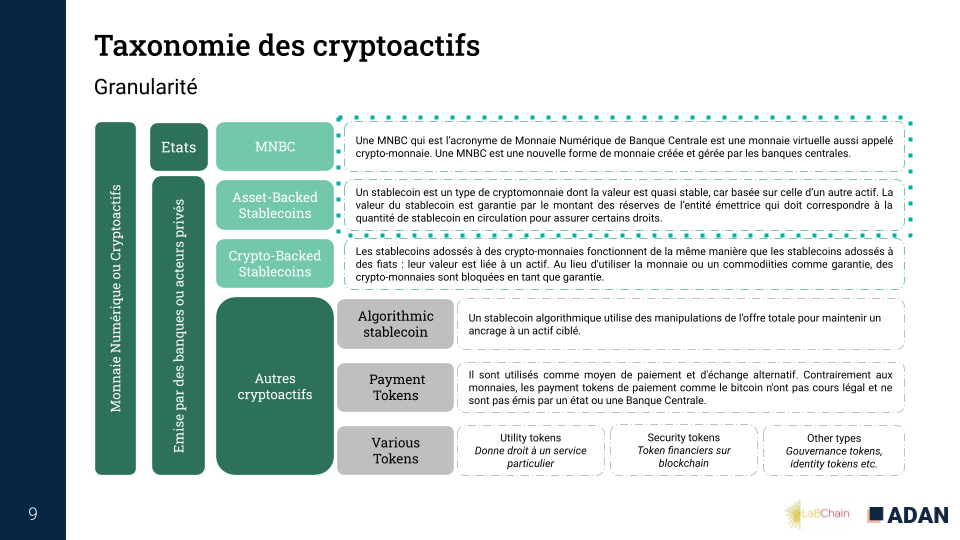

Sébastien Couture distinguishes between stablecoins as “native” crypto-assets (assets whose use and value derive entirely from their representation on a blockchain) and stablecoins as “non-native” crypto-assets (assets whose use and value derived from a combination of their representation on a blockchain and a picture of the value that lives outside a blockchain network). This distinction is based on Adan’s crypto-asset taxonomy.

Stablecoins have led to an acceleration in the development of the crypto-asset sector. They facilitate access to on-chain trading platforms, avoid conversion to fiat, improve arbitrage techniques, protect investors from the volatility of crypto-assets, and provide better long-term visibility on preferred investments and markets.

Sébastien Couture pointed out the risks associated with the massive use of stablecoins. These include counterparty risk, liquidation of collateralised positions and legal and regulatory risk.

“There are several use cases for stablecoins in DeFi, but stablecoins are used the most in trading. The liquidity of stablecoins in Defi has grown exponentially.” Mounir Benchemled

Mounir Benchemled then set about placing stablecoins in the context of decentralised finance (DeFi).

According to Mounir Benchemled, four types of protocols form the DeFi: lending (such as Aave), derivatives (such as Uma), exchanges (such as Uniswap) and aggregators (such as Paraswap).

There are a variety of uses for stablecoins in DeFi. First, there is trading since stablecoins can materialise capital gains without necessarily converting them into legal tender, the latter being subject to taxation. Stablecoins are also helpful for creating arbitrage opportunities between DeFi and CeFi. But stablecoins also have a timely interest in risk management, as the proven liquidity of stablecoins allows for the creation of derivatives.

Mounir Benchemled does not rule out the underlying risks of using stablecoins in DeFi. These risks may arise from inadequate collateralisation (for fiat-backed stablecoins) or malfunctioning (for crypto-backed or algorithmic stablecoins).

“The prospect of using stablecoins is opening up today. We imagine that Mastercard and Paypal will be able to do stablecoin transactions directly on the blockchain.” Xavier Lavayssière

Xavier Lavayssière then presented the regulatory and economic challenges of stablecoins.

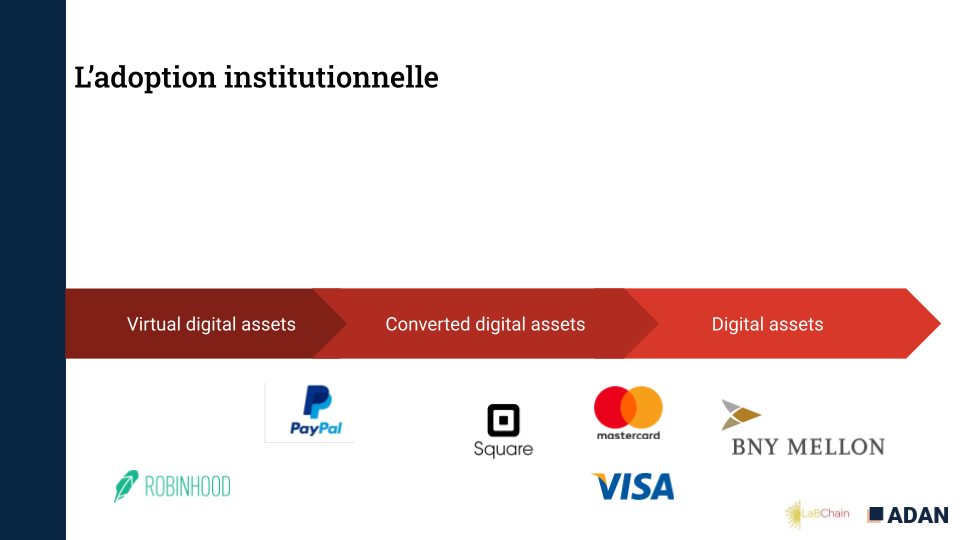

According to Xavier Lavayssière, stablecoins are now being adopted institutionally: Virtual digital assets (Paypal), Converted digital assets (Mastercard) and Digital assets (BNY Melon).

Private dollar stablecoins are over-represented (99.5%), while the share of euro-backed stablecoins is only 0.3%.

Today, the issuance of stablecoins is regulated as private actors issuing stablecoins must avoid a regulatory framework for registration and AML/CFT compliance.

Xavier Lavayssière reminds us that when a financial reserve backs stablecoins, this reserve can impact monetary stability. If Facebook launches a stablecoin, it could have many effects on market stability. The ECB (European Central Bank) has issued a report to address the risks associated with Diem’s reserve, taking into account various possible scenarios.

Finally, Xavier Lavayssière recalled the challenges of the European regulation of stablecoins with an analysis of the draft MiCA regulation. This draft regulation distinguishes between electronic currency tokens and tokens referenced to an asset, subject to a different framework. Finally, stablecoins of significant importance will be subject to increased regulation by regulatory authorities due to the impact these assets can have on monetary stability.

“In terms of monetary stability, there is a real challenge for France and the European Union to be at the forefront of this issue.” Pierre Person

The conference continued with the intervention of Mr Pierre Person, Member of Parliament, who is currently working on a report to the Parliament on stablecoins.

Pierre Person shared his convictions on regulating stablecoins and the progress of parliamentary work in this area. According to him, without powerful innovation, there will be no economic sovereignty. France must be attractive to individuals who would like to carry out such a project.

It would thus be counterproductive to over-regulate stablecoin usage. In regulating stablecoins, a distinction should be made between private and public stablecoins. Private stablecoins correspond to an ecosystem need for stability and market liquidity. In contrast, public stablecoins correspond to a reflection of central banks that have considered stablecoins to be a sovereignty issue.

According to Pierre Person, MNBCs are tools that will help the crypto-asset industry to flourish.

But there is also a need for flexibility in the regulation of private initiative stablecoins. There is no need to hinder the development of private stablecoins from ensuring the deployment of MNBCs.

Pierre Person shared a summary of his remarks in a series of Tweets.

Round Table – Internet of Money: Will the future of digital money be multilateral?

With Mounir Benchemled, Nadia Filali, Olivier Ou Ramdan, Christian Pfister and moderated by Grégory Raymond.

This round table firstly discussed the deployment of Lugh (EURL), the first French stablecoin backed by the euro. The co-founder of Lugh, Olivier Ou Ramdane, expressed the satisfaction of all the project members regarding the launch of this stablecoin, the first of its kind in France. The long-term objective will be to integrate other players into the project to promote the deployment and use of this stablecoin.

Lugh’s approach is currently French, but its ambition is to be exported throughout Europe.

Christian Pfister considers the interest rate differential can create a kind of dilemma for issuing stablecoins in euro. This forces issuers to charge fees for holding stablecoins, mainly to compensate for the fact that there is a shortfall in the reserve investment.

Nadia Filali considers that interoperability between private initiative stablecoins and MNBCs is necessary. Indeed, one should not criticise one stablecoin issuer over another, and it is essential to have coexistence between the different types of issuers.

In addition, the speakers debated around the opportunities that stablecoins allow for DeFi. Mounir Benchemled highlights that stablecoins have allowed for a separation from the once risky volatility that crypto-assets raised. In addition, regulated stablecoins (such as USDC) have allowed large institutions to get involved in DeFi.

Finally, the speakers underlined the need for an appropriate framework for stablecoins and crypto-assets in general.

“For the development of entrepreneurial projects, what we need is visibility and equal treatment. Regulation can be scary, as can decentralisation. But many things can facilitate regulation through innovation,” says Olivier Ou Ramdan

“French and European authorities should not be overly cautious to missing out on opportunities related to stablecoins.” Faustine Fleuret

Faustine Fleuret and Roxane Faure presented recommendations for policymakers, central banks and regulatory and supervisory authorities to promote the use of stablecoins in France and Europe.

The first recommendation aims to accompany the unstoppable transformation of the financial system by giving project leaders access to the essential tools for their development and providing public financial support that does not exist today.

The second recommendation is to build a regulatory framework that protects investors and financial stability, but that is also a catalyst for innovation: the framework for stablecoin markets must be adapted (it is not simply a question of banning them), decentralised stablecoins must be treated in a specific way, regulation must be proportionate, and the European Commission’s pilot scheme must allow the use of stablecoins. Last October, Adan had organised an event on the challenges of the MiCA and Pilot Regime, during which several speakers expressed their views on the conditions necessary for the development of the European ecosystem.

“Today, at the European level, we are witnessing regulatory uncertainty that is detrimental both to market confidence and to project leaders who need visibility to develop in the long term,” says Faustine Fleuret.

The third recommendation corresponds to the need to understand the opportunity to be seized (and above all not to be missed) to strengthen the competitiveness of the European industry. The EU needs to understand the challenge and opportunity of these innovations and follow the enthusiastic approach of the major international financial centres. “The argument of the competitiveness of the European industry is important to mobilise regulators and institutions to support the stablecoin industry in Europe. Finally, the stakes are linked to digital and technological sovereignty” says Roxane Faure.

Finally, the last recommendation aims to recreate a debiased analysis prism and a positive perception of stablecoins (and crypto-assets in the broadest sense) through a better understanding by public and institutional players of the benefits of these assets, and the actual levels of risk, beyond sometimes preconceived ideas. The objective and dispassionate analysis of crypto-assets, in general, is a fundamental underpinning for removing the persistent blockages faced by crypto players in general, which must now be overcome.